Materials Tech Pulse

The Hidden Battleground: The Role of Cleaning Formulations as a Strategic Link in the Semiconductor Supply Chain

The rapid rise of generative AI and high-performance computing (HPC) has propelled the global semiconductor industry into an unprecedented race for capacity expansion. Leading wafer foundries, integrated device manufacturers (IDMs), and advanced packaging service providers are investing tens of billions of dollars to bolster heterogeneous integration technologies, including CoWoS, FOPLP, and 3D IC. These technologies are essential not only for extending the trajectory of Moore’s Law but also for forming the foundation of the computational power required for AI and HPC.

As advanced packaging technology evolves at breakneck speed, the rules of the game are being rewritten. The introduction of heterogeneous integration architectures means that the significance of even the slightest process variation can be amplified, directly affecting yield performance and overall product competitiveness. As a result, the role of wet chemicals has undergone remarkable changes within this new landscape. Once positioned as back-end consumables, cleaning formulations have now become critical determinants of advanced process performance, packaging stability, and supply chain competitiveness. This paradigm shift has set the stage for the emergence of next-gen solutions. LCY Advanced Formulations, for example, is a portfolio of wet processing chemicals engineered to support the stringent requirements of the development of advanced semiconductor process nodes.

In advanced packaging, yield-related challenges have grown increasingly complex. For instance, incomplete removal of temporary bonding adhesive residues can cause on-resistance (Rds(on)) failures or abnormal electrical characteristics. Once such issues arise, they lead to irreversible yield loss and substantial cost impact. As a result, even minute levels of residue have become a critical pain point for both wafer fabs and OSAT providers. As global focus on environmental, health, and safety (EHS) standards intensifies, commonly used solvents such as N-methyl-2-pyrrolidone (NMP), tetramethylammonium hydroxide (TMAH), and dimethyl sulfoxide (DMSO) are now subject to strict controls under international regulations including REACH and RoHS. This regulatory pressure is accelerating the industry’s transition toward safer, more compliant alternatives.

Beyond technical demands and tightening environmental regulations, supply chain resilience and responsiveness have also emerged as critical challenges for the semiconductor industry. The sector has long depended on advanced materials from Japan and the United States. Today, to safeguard supply chain stability, wafer fabs and OSAT providers are increasingly turning to suppliers capable of rapid issue response, customized formulations, and reliable delivery. Consequently, wet processing formulations supported by localized production and flexible adjustment capabilities have become a key factor in selecting strategic partners.

With the ultra-precision requirements of next-generation semiconductor processes, high-quality wet chemicals must meet four key criteria.

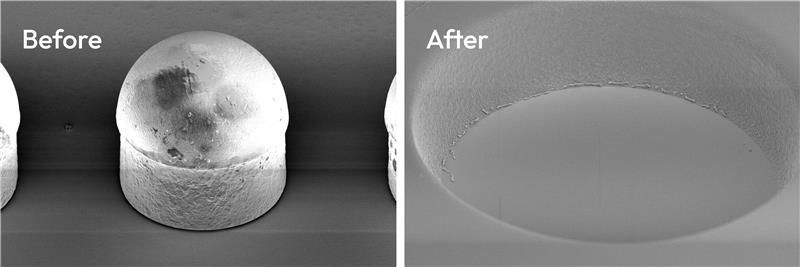

(1) Exceptional cleaning performance: The industry requires high-selectivity formulations capable of precisely removing specific material residues—such as polysiloxane, PMMA, PET, epoxy, and polyimide—without damaging adjacent structures. In the context of wet etching, copper-to-titanium selectivity ratios can reach 3000:1. LCY Advanced Formulations can fully remove the copper layer in 10 seconds, while titanium exhibits a thickness loss of only 5 nm after five minutes of immersion. Such level of precision supports process stability and enhances overall capacity utilization.

Figure 1: LCY Advanced Formulations precisely removes residual materials while fully preserving structural integrity.

(2) Safety and sustainability: As environmental protection and operational safety become non-negotiable standards, the industry is phasing out high-risk solvents in favor of low-volatility materials with high flash points, low VOC emissions, and room-temperature operating capability to reduce safety hazards. Furthermore, water-soluble photoresist stripper, compatible with existing wastewater treatment systems, is an effective solution for improving the fab working environment.

(3) Compliance with global sustainability standards: Driven by ESG considerations and international regulations, environmentally friendly formulations that can be reused multiple times and serve as alternatives to NMP, TMAH, and DMSO are gaining widespread adoption. These innovative solutions not only reduce emissions risks but also help companies maintain a competitive edge in supply-chain audits and global investment valuations.

(4) Localized supply and tailored solution capability: As AI-driven demand puts pressure on capacity expansion, the industry is placing increasing importance on locally sourced materials and the ability to make rapid adjustments, factors that LCY considers to be of the utmost importance. Formulations that can be quickly tailored to different process nodes and architectures, combined with co-development models with customers, shorten implementation schedules and enhance overall supply-chain resilience.

Wet chemicals are undergoing a structural transformation. No longer regarded simply as consumables for contaminant removal, they are now recognized as gatekeepers of yield and critical enablers of manufacturing stability. As advanced packaging technologies continue to evolve, yield competitiveness is shifting beyond design and equipment and entering a new phase increasingly defined by materials performance.

In this “hidden battleground,” cleaning solutions may operate out of sight, but they play a decisive role in enabling wafer fabs and OSAT providers to maintain stable throughput and high yield. As demand from AI and HPC continues to accelerate, the wet processing formulations market is growing rapidly and emerging as the blue ocean for investment and innovation in advanced packaging. Looking ahead, semiconductor competitiveness will depend not only on leadership in process nodes but also on securing an edge in these “invisible materials.” In a global landscape shaped by geopolitical tensions, environmental regulations, and cost pressures, only companies with leadership capabilities in materials innovation, sustainability, and supply chain resilience will excel in this largely unseen yet highly competitive race.